How to Designate an FX Contract

A quick guide on how to designate an FX contract in CNS for hedge accounting purposes

Why do we designate FX contracts?

FX contracts are designated for hedge accounting to manage currency risk and reduce financial statement volatility. By formally linking an FX contract to a specific exposure—such as a future payment or revenue—companies can ensure that gains or losses on the hedge offset fluctuations in the underlying transaction. This alignment with hedge accounting standards provides a more accurate reflection of financial performance, preventing misleading volatility and improving transparency in financial reporting.

Automated Designation

-

If your subscription includes automation, all FX contracts are automatically designated, and no manual action is required.

Manual Designation Methods

Method 1: Designate at Trade Date

-

Navigate to the Trade Details Screen

-

Go to FX View Data → View Currency Deals → Spot/Fwd.

-

Locate the FX contract in the grid.

-

Click the vertical ellipses (⋮) under the Action column and select Edit.

-

2. Enter Designation Details

-

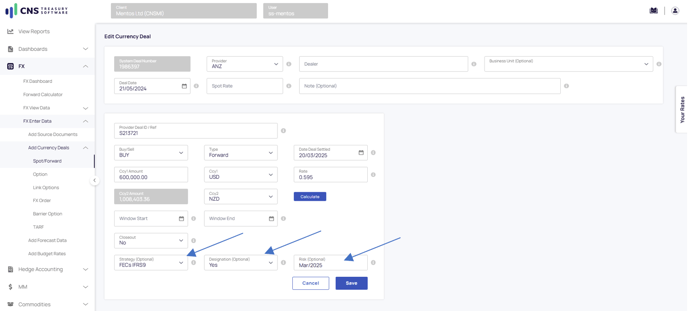

Scroll to the bottom of the trade details screen.

-

Fill in the following fields:

-

Strategy – Select the hedge accounting strategy the trade is tied to.

-

Designation – Select Yes to designate the trade.

-

Risk – Enter the month and year of risk exposure (e.g., Aug/2025 if the trade settles in August 2025).

-

3. Save the Designation

-

-

Click Save to apply the designation.

-

Note: This method only allows designation at the original trade date.

Method 2: Designate at a Custom Date

-

Navigate to Hedge Accounting Data

-

In the menu, go to Hedge Accounting → HA View Data → View FX.

-

Locate the FX contract in the grid - you will see which contracts are designated or not in the grid under the columns HA Strategy and Designated Balance.

-

Click the vertical ellipses (⋮) under the Action column and select Designate.

-

-

Enter Designation Details

-

Select the Strategy.

-

Enter the Risk period (e.g., Aug/2025).

-

Set the Designation Date (this can be different from the trade date).

- Enter in the Designated Amount

- (Optional ) Enter in a Designation Note

-

-

Save the Designation

-

Click tick to finalise the designation.

- Click the X to Cancel your entry.

-

Note: This method provides flexibility to designate the trade at a custom date rather than being restricted to the trade date.

![Primary Logo png-Dec-18-2023-02-56-38-8732-AM.png]](https://kb.cnstreasury.com/hs-fs/hubfs/Primary%20Logo%20png-Dec-18-2023-02-56-38-8732-AM.png?height=50&name=Primary%20Logo%20png-Dec-18-2023-02-56-38-8732-AM.png)